Child Tax Credit 2024 Canada Income – If you paid for childcare, you may also qualify for the child and dependent care credit. Depending on your circumstances, you can declare 20% to 35% of your childcare expenses. The maximum you can . Here’s how a proposed change in the rules for the child tax credit impact tax refunds and the upcoming tax season. .

Child Tax Credit 2024 Canada Income

Source : cwccareers.in

Samantha’s Law on X: “#Alberta Benefit Payment Dates. https://t.co

Source : twitter.com

Canada Carbon Tax Rebate 2024, Payment Date January, All Details

Source : www.kvguruji.com

How to fill out TD1 form if you have two jobs

Source : www.lucas.cpa

$600 Earned Income Tax Credit 2024 Know Income Limit & EITC

Source : cwccareers.in

FinancialFridays: Government Payments in January 2024 United Way

Source : unitedwayofbrucegrey.com

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

Tax Calculator: Return & Refund Estimator for 2023 2024 | H&R Block®

Source : www.hrblock.com

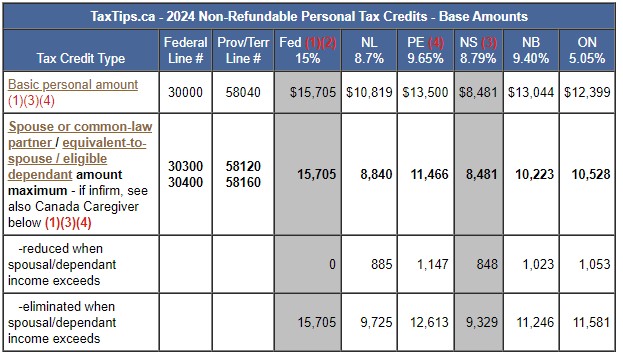

TaxTips.ca 2024 Non Refundable Personal Tax Credits Base Amounts

Source : www.taxtips.ca

Do You Qualify For The Earned Income Tax Credit? – Forbes Advisor

Source : www.forbes.com

Child Tax Credit 2024 Canada Income $600 Earned Income Tax Credit 2024 Know Income Limit & EITC : Also, you must meet several requirements to be eligible for the child tax credit in 2024. This story is part If your MAGI is higher than the income limits, the amount of child tax credit . Had or adopted a child in 2023? What new parents need to know about tax credits and deductions. Importantly, the enhanced Child Tax Credit went away in 2022. .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)